If you don't drink, smoke, or drive a car, you're a tax evader

If you don't drink, smoke, or drive a car, you're a tax evader

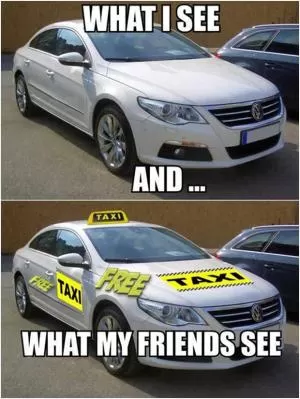

The statement "If you don't drink, smoke, or drive a car, you're a tax evader" may seem like a humorous exaggeration at first glance, but it actually touches on a very real issue in the world of car ownership and taxation. In many countries, owning a car comes with a host of taxes and fees that must be paid in order to legally operate the vehicle on public roads. These taxes can include everything from sales tax on the purchase of the car to annual registration fees and fuel taxes.For those who choose not to drive a car, either by personal choice or due to financial constraints, they may be able to avoid some of these taxes and fees. However, this can also lead to accusations of tax evasion, as some governments view car ownership as a necessary part of being a productive member of society. In their eyes, if you are not paying your fair share of taxes on a car, you are somehow cheating the system.

Of course, there are many valid reasons why someone may choose not to drive a car. Some people may live in urban areas with good public transportation options, making car ownership unnecessary. Others may have physical disabilities that prevent them from driving. And some may simply prefer to walk, bike, or use ride-sharing services to get around.

Regardless of the reasons for not driving a car, the idea that not owning a car automatically makes someone a tax evader is a flawed and unfair assumption. It is important for governments to recognize that there are legitimate reasons why someone may choose not to drive, and to ensure that their tax policies do not unfairly penalize those individuals.

Friendship Quotes

Friendship Quotes Love Quotes

Love Quotes Life Quotes

Life Quotes Funny Quotes

Funny Quotes Motivational Quotes

Motivational Quotes Inspirational Quotes

Inspirational Quotes